The United States stands for unlimited freedom like no other country. That's why you can expect a few surprises here - especially when it comes to health insurance, which is usually very expensive. Our guide explains the complex system of health insurance in the USA and informs you about your options.

To give you a better overview of the tariff jungle of health insurance for the USA, we have compared our two favorites among the different offers:

| Foyer Global Health - Special Insurance Plan |

Onshore Kare - Safe Travels USA Comprehensive |

|

|---|---|---|

| Recommendations | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Inpatient treatments | Included (accommodation in single or double room) | Included |

| Medical check-ups | Included, up to € 250 covered | Included, up to € 118 covered |

| Outpatient treatments | Included | Included |

| Age limit | None | 89 years |

| Dental treatments | Basic dental protection, incl. preventive check-ups, and surgical services | Painkilling treatments included up to 237 € |

| Eye examination/ vision aids/ eye test | Included, up to € 150 covered | On request |

| Medical return transport | Included (takeover up to € 3,000) | Can be added as optional module |

| Aids | Included, up to € 1,000 covered | Included |

| Insurance period | Unlimited runtime | Max. 2 years |

| Deductible | Variable between € 250 and € 1,000 | Variable between € 0 and € 4,744 |

| Cost | from € 806/ month (with € 1,000 deductible) | from € 237/ month |

| Discounts | None | None |

For immigrants, in particular, it is advisable to take out long-term health insurance for the first few months in the USA. However, before deciding on an insurance policy, it is important to clarify in advance whether the residence is to be moved abroad permanently or only for a limited period of time.

International health insurance is best suited for a permanent change of residence. The unlimited term and flexible design options are perfect for persons who want to receive the best possible health care abroad.

If your stay is to be for a limited time only, your residence is not to be moved permanently, or the insurance is only a temporary solution, then long-term international health insurance is the best option. It is mainly designed for emergency treatment abroad and can only be taken out for a limited period of time.

When it comes to health insurance, the United States is unique because they are the only industrialized nation without a universal, national health care system. Instead, you'll find a patchwork of different government programs and private providers in America.

A look at history reveals how this particular structure came about:

At the beginning of the 20th century, the Great Depression led to a sharp rise in poverty in the USA, so that many Americans could not even afford simple treatments. To counter this, the Social Security Act was passed in the 1930s, aiming to guarantee more security in old age.

The law was extended to health care in 1965 under President Lyndon B. Johnson. From then on, seniors aged 65 years and older and disabled people were covered by Medicare, while low-income populations, in particular, were covered by Medicaid.

All citizens who did not qualify for the government programs had to secure their health coverage independently through private health insurance.

In 2008, nearly 46 million Americans (about 15% of the total population) lacked health insurance. The healthcare reform known as "Obamacare," which completely reorganized access to health insurance, was a milestone for the American healthcare system.

Obamacare primarily included the following changes:

The reform provided much better access to the system, especially for the socially disadvantaged. President Obama's Affordable Care Act was approved in 2010 and enabled millions of previously uninsured Americans to afford health insurance, partly with government subsidies.

The mandatory insurance introduced in 2014 led to a significant drop in the proportion of people without insurance.

Although the Affordable Care Act's increasing insurance coverage was evident, the Trump administration was working on an alternative to Obamacare and would have preferred to undo the reform. However, this would have required approval by Congress.

When a new tax law was passed at the end of 2017, however, the penalties for the uninsured were abolished again, which meant that the obligation to provide health insurance no longer existed as of 2019. An important pillar for financing Obamacare thus fell away.

The administration of President Joe Biden has once again been naming the issue of health as one of its top priorities. Under Biden, the Affordable Care Act has been brought back into focus and between 2019 and 2023, the number of Americans without health insurance fell from 33.2 million to 25 million.

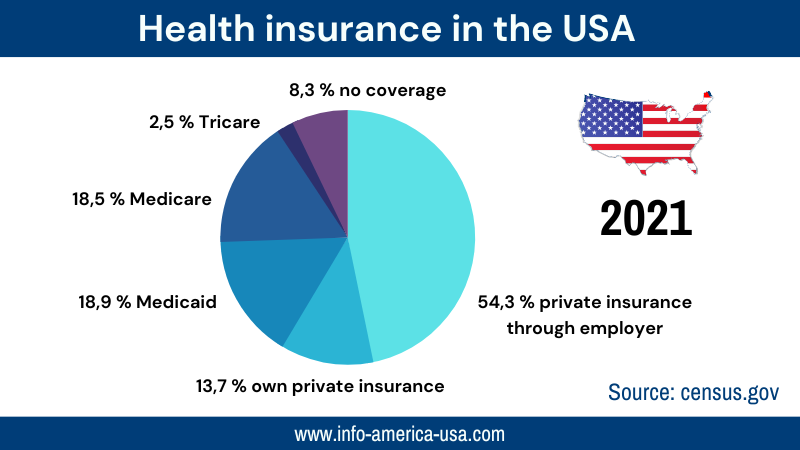

Medical care for Americans is provided through several separate insurance systems and is divided between private providers and government programs.

Only some groups of people have the opportunity to benefit from public health insurance in the United States. At the state level, there are these three programs:

Established under the Social Security Act, Medicare is designed to provide health care for elderly and disabled citizens. Any American age 65 or older is eligible for Medicare benefits. Citizens with a recognized disability, or acute kidney failure, are also protected by Medicare.

Green Card holders aged 65 and older can also benefit from Medicare. To qualify, they must have been a Permanent Resident of the United States for at least five years and have lived in the USA for five consecutive years. Green Card holders should also be able to prove at least ten years of working history in the United States. If the time of employment is shorter, a co-payment is due, whose amount is determined by the number of years completed.

Medicaid stands for "Medical Assistance" and is a welfare program designed to support children and low-income populations in particular. Since it is a welfare-like benefit, there is a review regarding the level of need before Medicaid can be received.

Tricare is a health insurance program for members of the American military. It was established in the 1960s and provides civilian health benefits to active and former military members and their families, National Guard members and their families, survivors, some former spouses, and recipients of Medals of Honor and their families.

The majority of the US population does not qualify for government benefits and must accordingly arrange their own insurance coverage through a private provider.

With an ESTA, you can stay 90 days visa-free in the USA. Apply online now!

Most US citizens are covered by private health insurance through their employer. Group health insurance policies are often taken out for the entire company, with employer and employee sharing the costs.

However, employees frequently have to pay extra for the services they use or take out additional private insurance. Since the employer is the contractual partner for the insurance coverage, the health insurance usually also ends when the employee loses their job.

Since the introduction of "Obamacare," people who have to look for private health insurance on their own – without the support of an employer – can find and purchase suitable insurance coverage through the US government's Marketplace.

Depending on one's region of residence, there are different types of insurance designed to meet different needs. When buying health insurance, you can usually choose between the following three types:

In general, medical care in the USA is of a high standard. There are a large number of private clinics with modern equipment and state-of-the-art technology. However, the health care costs in the USA are among the highest in the world.

A number of factors are driving up health care costs in the United States:

Burgers, soft drinks, sweets: Many Americans maintain an unhealthy diet. The Centers for Disease Control and Prevention (CDC) states that around two in five adult Americans are obese. The associated health risks (e.g. diabetes, heart disease) increase the costs to the healthcare system.

Many uninsured or insufficiently insured Americans avoid non-essential doctor visits. As a result, illnesses often go undetected or are not treated in a timely manner, which in turn leads to high treatment costs in the long term.

American hospitals and clinics include potential future lawsuits for compensation payments in their pricing. Since each facility can determine its own prices, simple items such as handkerchiefs or plastic cups can become "luxury items" with hefty prices on the hospital bill.

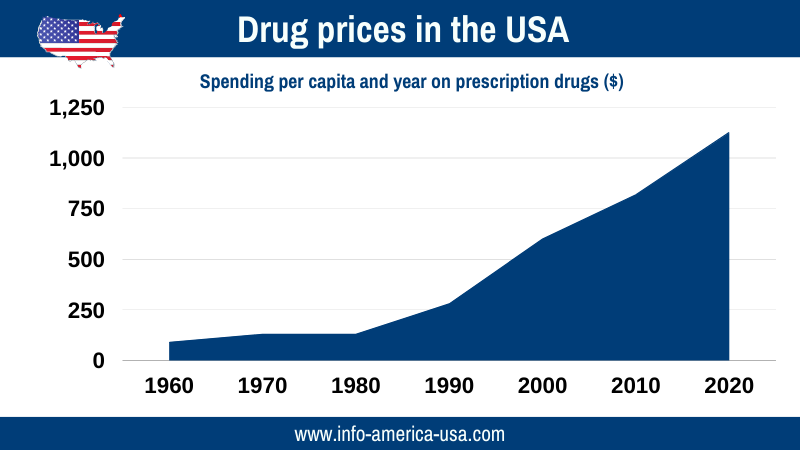

Drug prices in the United States have been rising since the 1950s and are today at an all-time high. Compared to residents of other industrialized nations, people in America pay 2.5 times as much for prescription drugs. According to US pharmaceutical companies, the cause of the extremely expensive drug prices lies in the high cost ofmedical research and the development of new drugs.

Due to high healthcare costs, insurance premiums in the USA are very expensive. As a result, some of the population cannot afford health insurance or can afford it only with difficulty.

Many US citizens choose insurance that frequently does not cover all costs, so that they have to pay or co-pay for medical services themselves in some cases. According to the US Census, as many as 26 million Americans– around 8% of the total population– had no health insurance at all in 2023.

American legislation guarantees that hospitals must care for everyone in medical emergencies. However, uninsured Americans are generally expected to pay for their own medical care in the event of illness. Not surprisingly, the most common reason for personal insolvency involves medical bills following hospitalization.

In New York, treating a US expatriate for 42 days in intensive care with artificial ventilation costs about € 478,000. At the rates applicable in Germany, a hospital receives about € 29,000 for the same treatment.

While the state regulates and ensures the health care of its citizens in most Western industrialized nations, individual initiative is necessary in the United States!

For example, health insurance in the US differs greatly from that in European countries. Let's take a look at the most important features of the US health insurance system in comparison to the German system:

| Germany | USA | |

| System | Based on the social state | Hardly any interference by the state, insurance market determined by economic interests and competition |

| Organization | Public or private | Mainly private, state insurance only available for seniors and people in need |

| Financing | Social security contributions for employees and employers | Self-pay, possibly co-payments by employer or state subsidies |

| Special features | Limited range of services, cost increases due to demographic change, co-payments for dental treatment | High number of uninsured people, partially limited choice of doctors, high drug prices and treatment costs, health insurance coverage tied to the workplace |

Choosing a suitable health insurance plan is an important point on the to-do list of US immigrants. If you want to avoid being surprised by high health care costs in case of an emergency, you should make sure you have sufficient coverage before you move to the United States.

It is recommended to take out an international travel health insurance policy to cover the first months of your stay in the United States. You can already arrange for such international health insurance in your home country.

International health insurance should cover the following costs:

Protected by suitable international health insurance, you can then take the time to inform yourself about the American insurance market thoroughly.

With an international health insurance, your medical coverage remains as uncomplicated as you are used to at home. Our partner Foyer Global Health provides international health insurance specifically designed to meet the needs of expatriates. With international health insurance policy from Foyer Global Health, you will enjoy the following benefits, among others:

The Foyer Global Health team will be happy to advise you: Get your offer now!

The market for health insurance in the USA is very complex and diversified. You should compare the policies offered very carefully, as they consist of different packages and often do not include dental benefits, for example. When comparing insurances, ask yourself the following questions:

If you were enrolled in public health insurance in your home country, you usually cannot continue with the same insurance in the USA. If you come from an EU country, for example, you automatically lose your insurance coverage when you leave the European social security system.

However, in Germany, for example, it is possible to maintain a so-called "Anwartschaftsversicherung" with the public health insurance, so that your coverage is temporarily inactive, and can be resumed under the old conditions when you return to Germany.

There are also many reasons for taking out private health insurance in your home country. German insurance law, for example, offers some significantly better conditions compared to the USA.

Thus, people insured through a German private health insurance company in the US continue to be subject to the German Insurance Contract Act, which governs all providers and insurance companies in Germany.

USA travelers can also see a doctor at short notice in the event of illness or visit the Emergency Room in emergencies. It is highly advisable to obtain private international travel insurance before the trip because medical treatment in the United States can be very costly.

Any treatment costs, rescue costs, or transport costs back to your home country usually have to be paid on the spot. The public health insurance companies do not cover these costs, but travel health insurance companies will reimburse the money. Therefore, always get a detailed receipt that includes all costs and treatments as well as the diagnosis codes.

When you purchase travel insurance for the USA, make sure it best includes the following services:

The land of opportunity is known for its outstanding academic facilities. If you are planning a temporary yet long-term stay in the USA (e.g., study, internship, au pair stay), you should also make sure you have sufficient health insurance coverage abroad.

For studies or other longer stays in the USA, special travel insurance policies can be purchased for a period of up to 5 years. Make sure that important benefits such as costs for medical treatment, medication, a hospital stay, transportation costs, etc., are covered.

Retirees who want to move to the USA should inform themselves about the topic of health insurance well in advance of their departure in order to avoid possible high medical costs. Citizens of European countries who stay outside the EU, for example, lose the protection provided by the public health insurance of their home country and should therefore obtain an international health insurance policy.

There are two options: you can either fight your way through the jungle of offers by the many American providers of private health insurance, or you can take out a long-term international health insurance policy for seniors back in your home country. The latter is usually valid for a certain period of time (usually one year, at most five years) and must be purchased again for a longer stay or for the next stay in the USA.

Everyday life in the USA can be full of surprises and challenges. However, with our guides, you will be well prepared for your new life in the States! Learn more about the school system, tax system, driving, or naturalization in the USA.

Win one of 55,000 Green Cards in the official Green Card Lottery of the US authorities!